GB POUND

A solid week for the UK economy and the pound.

The pound started the week at 1.1611 against the Euro and 1.3111 against the US Dollar, and the upward trend continued as a raft of positive data regarding the health of the British economy.

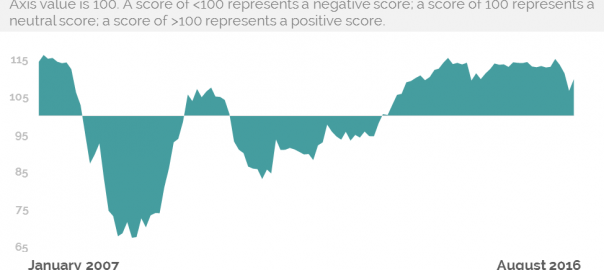

A YouGov/Cebr survey showed that consumer confidence has increased. The headline number increased 3.2 points to 109.8 in August, this is the biggest monthly increase since February 2013.

GDP for the second quarter increased from 0.4% to 0.6%, the main driver of this growth has been a rise in consumer spending. It would seem “Brexit” has been very good news for luxury watch manufacturers, as reports show Swiss watch sales have increased by 13% in July as tourists take advantage of the drop in the value of the pound.

Bad news for Scotland as the Government and Expenditure Revenue Scotland (GERS) reported that North Sea oil revenues have fallen 97% in the past financial year. Figures showed that oil revenues fell from £1.8bn to £60m between 2015 and 2016, data also showed that Scotland’s deficit (the difference between what the government spent and earned) was now 9.5% of GDP £14.8bn for 2015-16.

The current UK deficit is 4% of GDP £75.3bn. These figures make a compelling argument for those who believe Scotland would be better off if it remains part of the UK.

EURO

Official data shows that growth in Germany has slowed. GDP for the second quarter was 0.4%, compared with 0.7% in the first quarter.

Concerns that the eurozone would suffer substantial economic damage after Britain voted to leave the EU seems to be unfounded, as the August composite HIS Markit survey (which brings together manufacturing, service and construction data) suggested that growth across the EU will continue at 0.3% a quarter and 1.2% for the year.

Greece’s bailout programme is under threat as its former statistics chief Andreas Georgiou is currently under investigation by the Greek supreme court, as its been alleged that he rigged official economic data during the debt crisis.

US DOLLARS

A tough week for the US dollar despite a raft of positive data releases.

New homes sales increased by an impressive 12.4% month-on-month in July the fastest rate in nearly 9 years.

US durable goods orders beat expectations, forecast at 3.3% the figure came in at 4.4% for July, a marked improvement from the 4.2% fall in June.

On Friday the markets waited with bated breath for Fed Chair Janet Yellen’s address at the Jackson Hole symposium in Wyoming.

Yellen’s tone was upbeat, but cautious regarding the current state of the US economy, she said “In light of the continued solid performance of the labour market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months."

Elsewhere

Data showed that trade balance in New Zealand has declined month-on-month, forecast at -350m it came in at -433m. Trade balance measures the difference in value between imported and exported goods and services over a set period. A positive number indicates that more goods and services were imported and is known as a trade surplus. A negative number means there is a trade deficit.

Japanese consumer price index (CPI) has dropped for the fifth month in a row. Figures showed that CPI for July was 0.5%, this is the biggest drop in more than three years. These latest figures will be another blow to prime minister Shinzo Abe’s efforts to steer the Japanese economy away from deflation. I wonder if he is now regretting his decision to emerge from a green pipe dressed as Super Mario at the Olympic closing ceremony in Rio last Sunday!

YouGov/Cebr Survey Showed that UK Consumer Confidence has Increased